CLASSIFICATION

Our extensive inventory as an electronic component distributor includes memory chips, power management ICs, 4G/5G modules, WiFi modules, sensors, SoCs, Ethernet components, CPUs, RF power amplifiers, etc.We source these products directly from renowned electronic component manufacturers, ensuring unparalleled quality & reliability. Trust our electronic component wholesaler to be your reliable partner for all your electronic component needs.

Flash Memory

Flash Memory

PMIC

PMIC

4G/5G Module

SoC

Sensor

MCU

We can Solve

Avoid price volatility

Technical support

Quality asssurance

Delivery stability

Answer alternative model

Support batch

Featured Products

Phison SSD

Agent and Distributor of Phison products SSD, EMMC, USB, UFS, SATA SSD and Pcle SSD with ODM and OEM service.

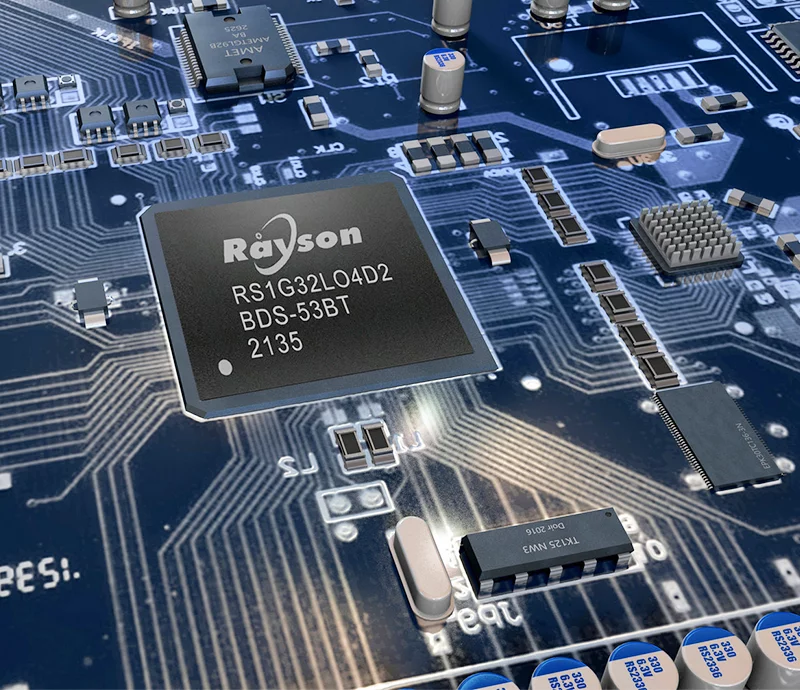

Rayson Memory

Agent of Rayson memory products DDR3, DDR4, LPDDR3, LPDDR4, eMMC, and eMCP are widely used in multiple fields such as mobile phones, tablets, OTT boxes, in vehicles, artificial intelligence, and the Internet of Things.

Winbond Memory

Winbond's main products for storage chips are NorFlash, Nand Flash, and DDR, committed to providing global customers with comprehensive niche memory solution services. The core products include Code Storage Flash Memory and TrustME ® Secure Flash, Specialty DRAM, and Mobile DRAM

We source only the best electronic component around the world and establish long-term cooperation with the following partners. It is our focus on valuable partnerships, reliable supply and personalized service that makes INDASINA a distinguished choice among bulk electronic component distributors. We look forward to discussing how we can meet your electronic component needs now and in the future.

NEWS and Information

How to program Winbond?

To program a Winbond chip, you can follow these steps, keeping in mind the role of a Winbond distributor: 1. **Select the Right Programmer**: Choose

What is the best brand of RAM: Samsung, Kingston or Corsair?

When it comes to the best brand of RAM, it’s important to consider performance, compatibility, aesthetics, and price. Among Samsung, Kingston, and Corsair, Corsair is

PHISON commercial eMMC/UFS & BGA SSD Selection Guide

Grade cost performance Medium to high order Higher order Higher order Flagship Product eMMC UFS UFS PCle PCle Interface 5.0/5.1 2.1 /2.2 3.1 PCle Gen.3×2

eMMC VS UFS ?Similarities and Differences

Both UFS (Universal Flash Storage) and eMMC (embedded Multi-Media Card) are types of non-volatile storage technologies used in mobile devices and other electronics. They are

INDASINA TECHNOLOGY CO. LIMITED

Founded in 2009 in China and awarded as a National High-Tech Enterprise in 2019 with dozens of technical patents, INDASINA is committed to providing complete solutions of variety of electronic components.

As a leading intelligent products supplier and reputable electronic components wholesaler, INDASINA offers overall solutions and builds the intelligent world of IoT for more than 5,000 partners globally with strong R&D capability and global elite sales team. We are dedicated to serving as the top electronic component distributor for our clients with our extensive inventory, competitive pricing and prompt delivery.

INDASINA continuously offers reliable and competitive electronic components and modules, technical solutions for AIOT, PC/ NB, Automobile, Data Server, and household appliance as well as smart security products. Additionally, INDASINA cooperates with supply chains, partners, industry associations, universities, and institutes to build a win-win Social Ecosystems to promote technological innovation and industrial development. As an leading distributor for electronic components with a global presence, we strive to meet the needs of our partners and support their work through tailored solutions.

Send Us A Message